Do Vespa scooters run on vespene gas?

Tag: fuel

No Price Is Right

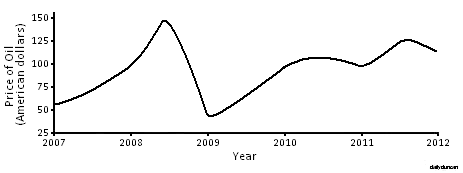

The price of oil has a significant effect in the global economy. As fuel prices have risen over the years, so has the cost of doing business, since nearly all industries rely on some form of mechanized transportation. When the price of oil reached an all-time high in 2008, many companies felt suffocated under the weight of the dramatic increase in costs.

For the transportation industry – airlines in particular – the soaring cost of oil directly and drastically affected their operating costs. Under such intense pressure, a company would have only two options: raise prices in an attempt to maintain profit and risk losing market share, or maintain prices in order to keep market share, resulting in reduced profit. Neither of these options seemed particularly attractive, then lightning struck.

To counteract the ever-escalating price of oil, transportation companies introduced the fuel surcharge. The idea is simple: in order to avoid raising prices, a separate charge is billed to the customer which offsets the increased cost of fuel. By doing this, the company can maintain consistent prices while shifting the blame for the additional charge to an external entity. At first glance this would seem like a reasonable and transparent business practice, but there are some serious problems here.

First, companies that use fuel surcharges are not telling us the entire fuel cost for our purchase; they are only telling us the cost in addition to some undefined amount already hidden in the bill. This assumes that there is a baseline for how much fuel should cost, but there is no correct price of fuel or any other commodity, for that matter. Prices constantly fluctuate based on economic and political factors far too complex and numerous for any network news analyst to predict. Also, what would happen if the price of fuel were to descend below the established correct amount, as it did in 2009? It would have been quite naive to expect a fuel rebate on our bill.

Another serious problem with fuel surcharges is consistency. If companies are going to start treating fuel costs as a separate expense, why not do the same with labor, taxes, raw materials or electricity? Some restaurants automatically add the tip to the bill in order to excuse customers from the senseless dance of determining an appropriate reward for carrying out what is expected, but there are many other charges that also affected the cost of the meal. Though it’s true that oil prices have proven particularly volatile, costs are always on the rise, so why not show us all of them? Perhaps we would be better off if our receipts revealed every cost involved in generating the purchase price, but that isn’t going to happen any time soon.

Aside from being inconsistent, fuel surcharges can also be used to raise prices without absorbing condemnation. Couriers, for example, are known to list fuel surcharges on deliveries that do not require a deviation from previously scheduled routes, which means that they are billing a fuel surcharge when there is no additional fuel cost involved. Far from clarifying the billing process to the customer, fuel surcharges have created a more convoluted, inconsistent and arbitrary pricing protocol.

There is no correct price.